How to Link PAN with Aadhaar: A Step-by-Step Complete Process

Aadhaar Pan Link: Are you tired of constantly being reminded by the government to link your PAN with Aadhaar? Don’t worry; we’ve got you covered. In this article, we will take you through the complete process of linking your PAN with Aadhaar in a step-by-step manner.

Importance of Linking Aadhaar with PAN

Linking your Aadhaar and PAN cards is mandatory as per the Income Tax Department of India. It helps eliminate fraudulent activities related to taxes and streamlines the taxation process. If you fail to link your Aadhaar with PAN, your PAN card will become invalid. Hence, it is crucial to link your Aadhaar with PAN.

Step-by-Step Process for Aadhaar Pan Link

Follow the below steps for Aadhaar Pan Link:

Step 1: Visit the Official Website

Visit the official website of the Income Tax Department of India. Click Here

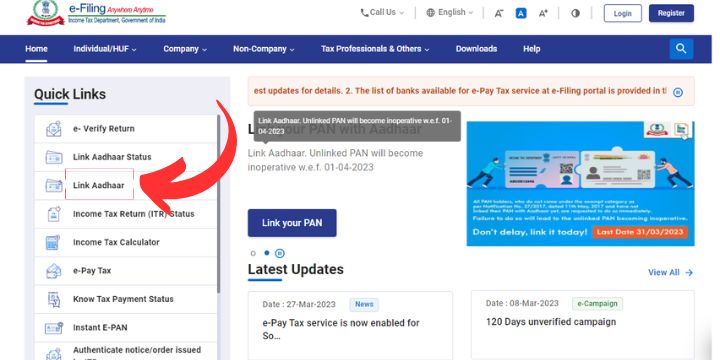

Step 2: Click on ‘Link Aadhaar’

Under the ‘Quick Links’ section, click on ‘Link Aadhaar.’

Step 3: Enter Aadhaar and PAN Details

Enter your Aadhaar and PAN details, along with your name as mentioned in your Aadhaar card.

Step 4: Verify Details

Verify the details entered by you before submitting.

Step 5: Click on ‘Link Aadhaar’

After verifying the details, click on ‘Link Aadhaar.’

Step 6: Confirmation

A confirmation message will appear on the screen indicating that your Aadhaar and PAN are linked.

Offline Process for Aadhaar Pan Link

In case you are unable to link your Aadhaar and PAN online, you can link them offline by following the steps mentioned below:

Step 1: Download the Form

Download the form for linking Aadhaar and PAN from the official website of the Income Tax Department of India.

Step 2: Fill the Form

Fill the form with your Aadhaar and PAN details, along with your name as mentioned in your Aadhaar card.

Step 3: Submit the Form

Submit the form along with a photocopy of your Aadhaar card and PAN card to the nearest NSDL e-Governance branch or PAN service center.

Step 4: Confirmation

After verification of the details, you will receive a confirmation message on your registered mobile number and email address.

Frequently Asked Questions (FAQs): Aadhaar Pan Link

Q.1 Is it mandatory to link Aadhaar with PAN?

Yes, it is mandatory to link Aadhaar with PAN.

Q.2 Can I link multiple PAN cards with a single Aadhaar card?

No, you can link only one PAN card with a single Aadhaar card.

Q.3 How long does it take to link Aadhaar with PAN?

Linking Aadhaar with PAN online hardly takes a few minutes, while offline linking can take up to 15 days.

Q.4 What happens if I fail to link Aadhaar with PAN?

If you fail to link Aadhaar with PAN, your PAN card will become invalid.

Q.3 Can I link my Aadhaar with PAN offline?

Yes, you can link your Aadhaar with PAN offline by submitting the form to the nearest NSDL e-Governance branch or PAN service center.

Q.4 What is the last date for Aadhaar-PAN Link 2023?

Aadhaar Card Linking Deadline Extended Till June 30

Q.5 Can we link Aadhar to PAN in Mobile?

Yes, Using Official Website of Income Tax Department

Q.6 Is Aadhaar PAN linking free?

Yes its a totally free process with time limit.

Conclusion

Linking your Aadhaar and PAN is essential to avoid any complications related to taxes. In this article, we provided a step-by-step guide for linking your Aadhaar and PAN, focusing on the main keyword “Aadhaar Pan Link.” We hope that this article has been informative and helpful. If you have any queries or face any difficulties while linking your Aadhaar and PAN, you can visit the official website of the Income Tax Department of India for assistance.